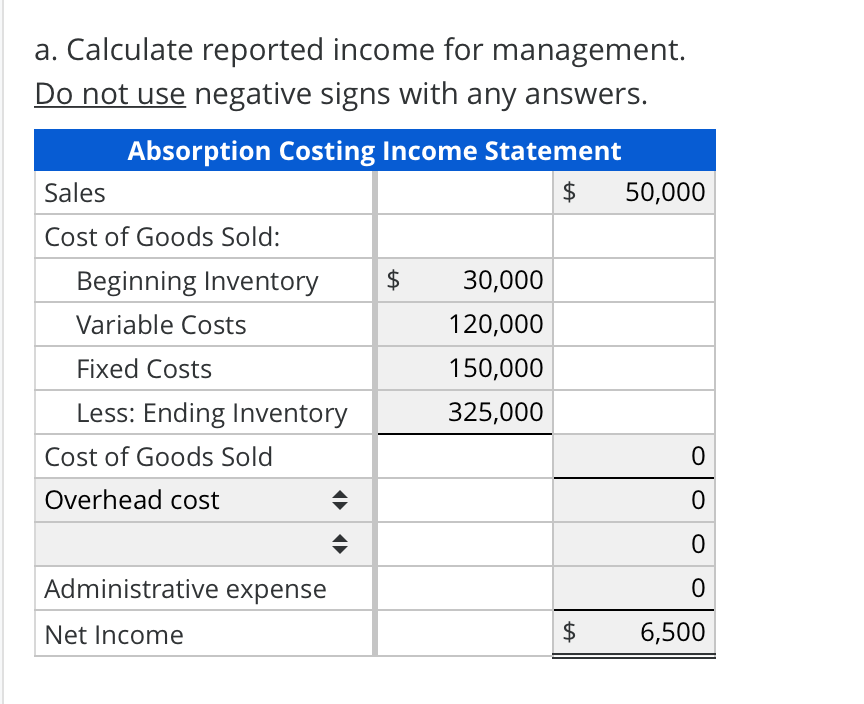

The basic formula for calculating COGS is fairly straight forward: For a restaurant, the largest cost is likely the cost of food used to prepare meals.

This includes both direct and some indirect costs.įor retailers, the largest cost is likely the cost of buying items for resale. It only examines the costs incurred when producing the company’s items for sale. Service providers like law firms, software engineering firms and consultants don’t use COGS since they don’t manufacture anything.ĬOGS does not include all of a company’s costs.

It includes direct costs like manufacturing overhead, materials and the cost of labor. The COGS of a business indicates how efficiently that business manages its supplies and workforce in manufacturing its product.

#COGS INCOME STATEMENT HOW TO#

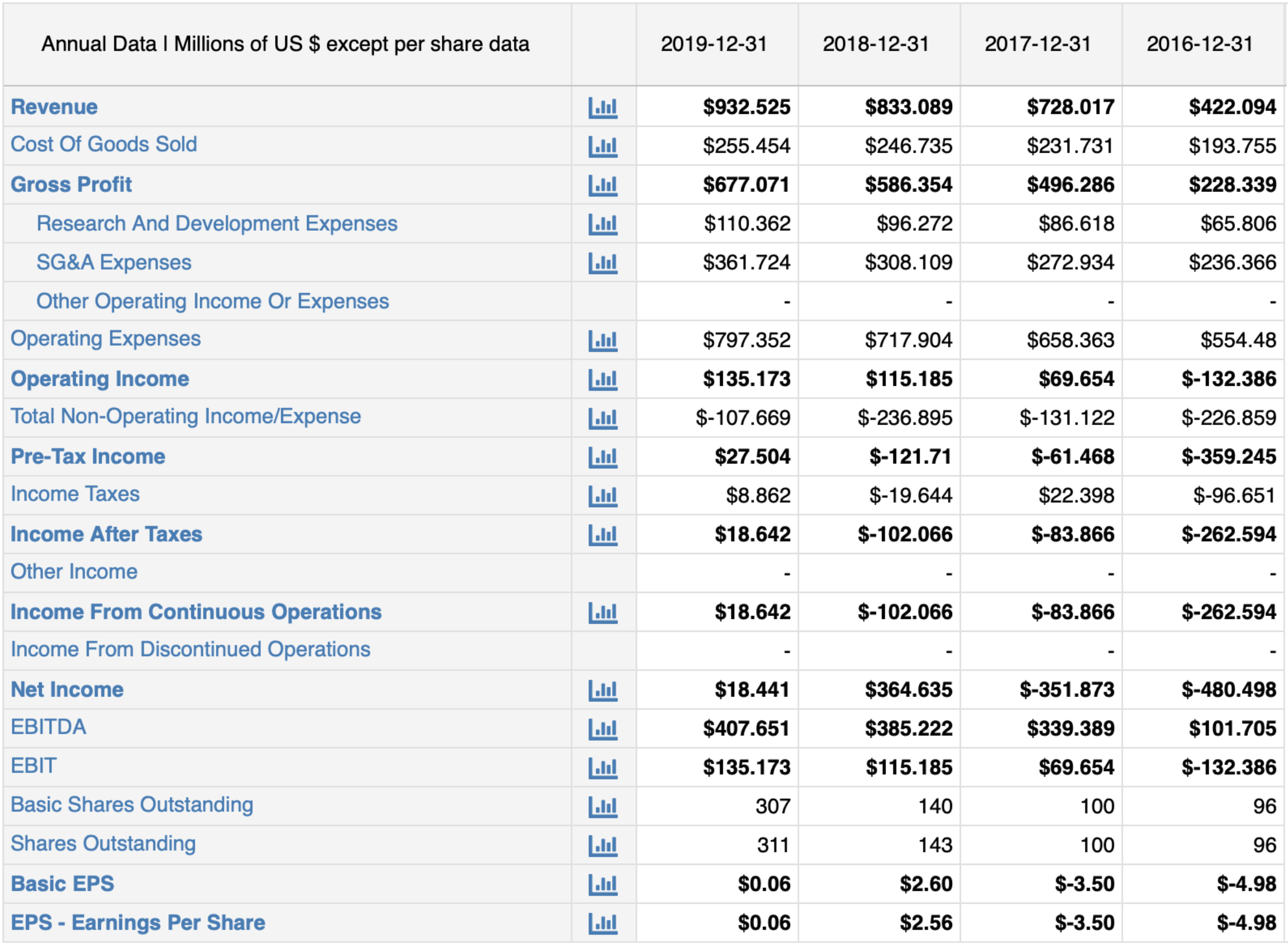

For investors, a high COGS can suggest a cap on potential profitability, while a low COGS can indicate a competitive advantage. Learn how to calculate this important metric here. Internally, business executives focus on COGS when pricing the company’s products offered for sale. The IRS relies on it to determine a company’s tax bill. Cost of goods sold (COGS) is the determination of how much it costs retailers, wholesalers and manufacturers to produce the goods they sell. For makers and resellers of products, COGS, sometimes also referred to as “cost of sales,” appears on an income statement where it is central to calculating gross profit.

0 kommentar(er)

0 kommentar(er)